-

Product

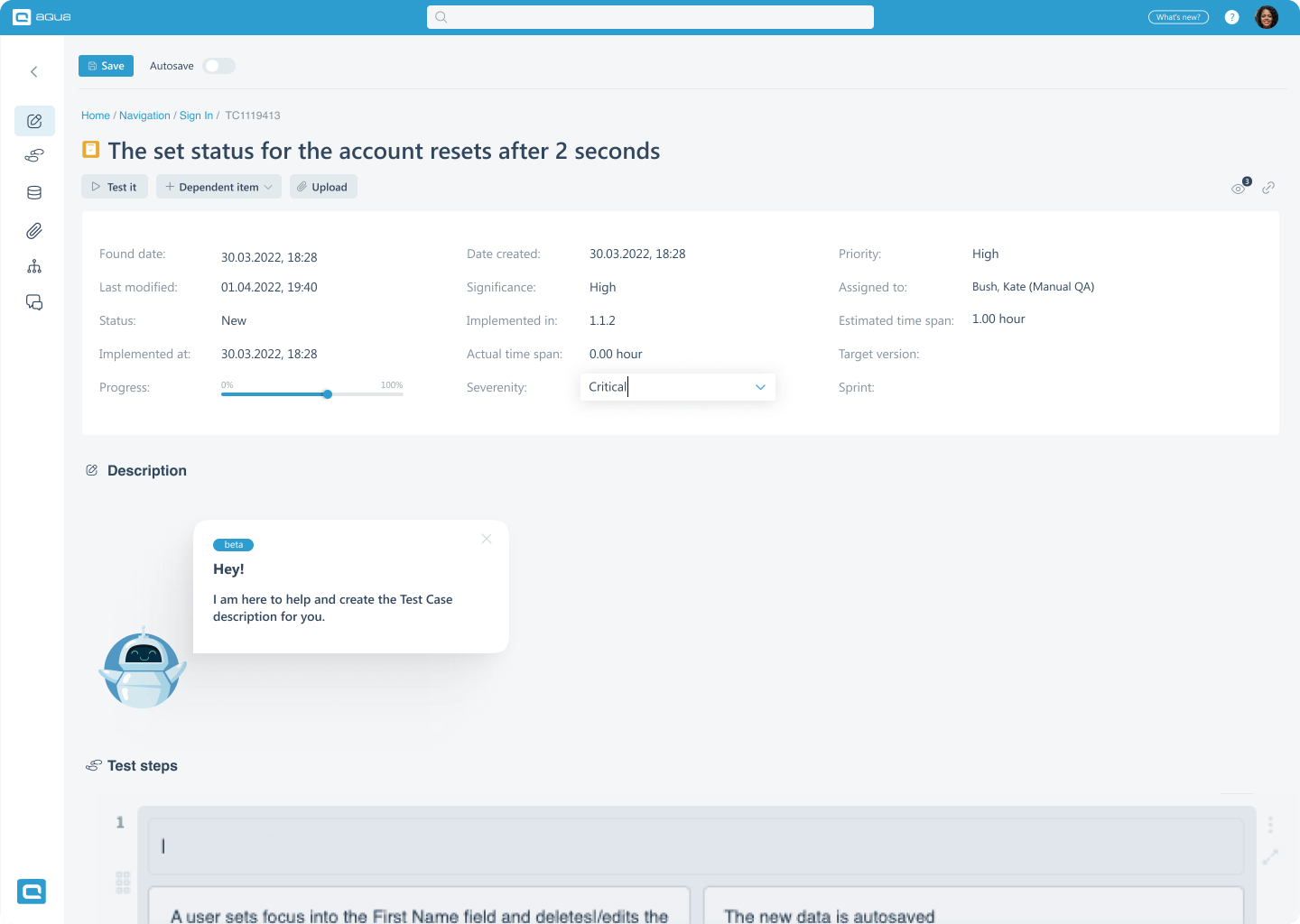

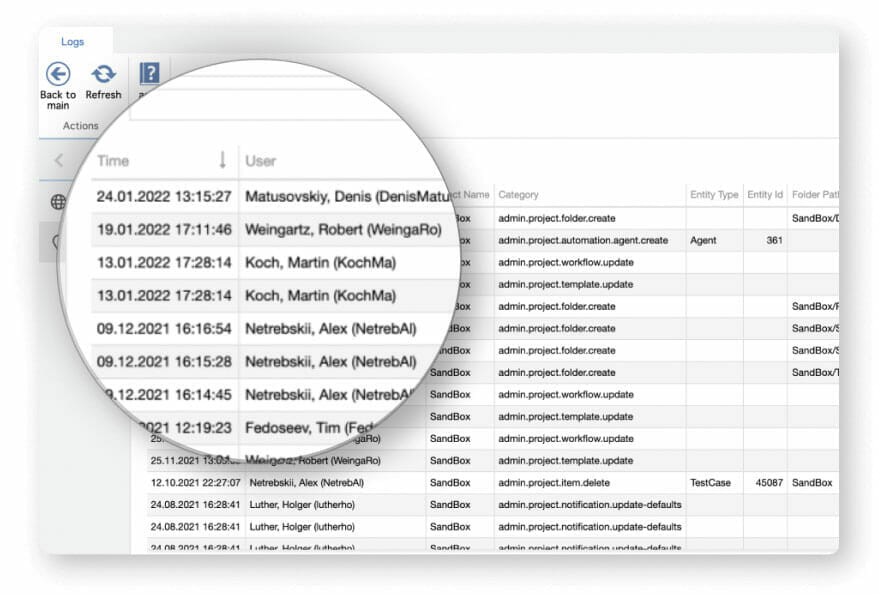

Features

-

Solutions

IndustriesBankingaqua ALM helps banks increase testing productivity by over 50%InsuranceConsistent testing with aqua ensures robust insurance software that increases retentionManufacturingUsing aqua helps an IoT manufacturer save 3% of revenue by reducing production defectsGovernmentaqua paves the way for digital transformation with a portfolio of 7 government organisationsTech companiesaqua helps reach a defect detection ratio of 98% with thorough and efficient testingMedicalaqua proudly serves 10+ enterprise medical companies to level up their QA

- Pricing

-

Resources

LearnBlogTips & tricks on how to manage testing process effectively and speed up releasesaqua wikiDetailed information on aqua capabilities, functionality and featuresProduct updatesDescription of our newest features and their value to QA teamsSuccess storiesCompanies that want to keep up with digital change trust in aquaProduct FAQFast answers to the most important product questionsData centersExplore our infrastructure & global locations